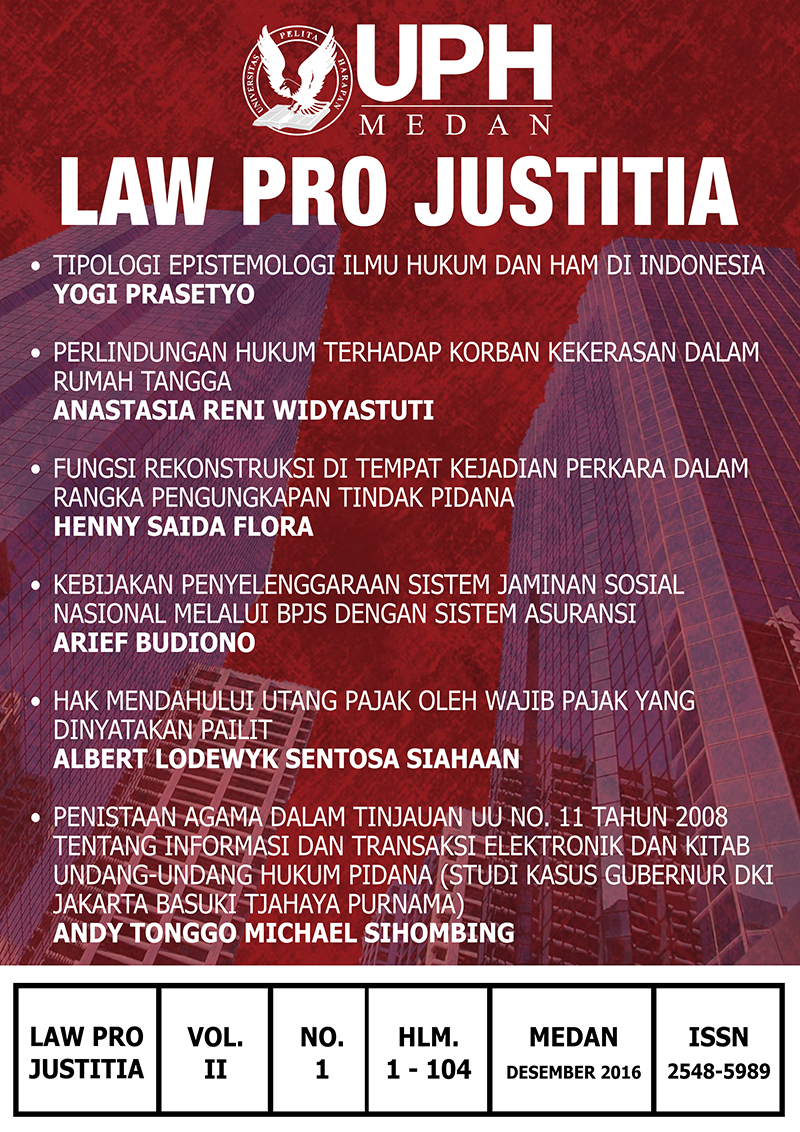

HAK MENDAHULUI UTANG PAJAK OLEH WAJIB PAJAK YANG DINYATAKAN PAILIT

Abstract

This study aims the to analyze how the determination of the right before debt taxpayers which declared bankrupt by a court, this research using a kind of research normative namely research on principle of law, legal sources, legal theories, books and legislations. This studies state that the constitution general provinsions taxation says is a creditor preferen expressed have has the right before over good belonging to the person in tax that would be auctioned in public discussions. Similary relation to emphasized the privilege have the higher levels of the creditor other because regulation. Preferied lender revealed have the right preceded as provided specifically by law General provisions Taxation led to the country having the right preced over the good belongs to Tax Insurer and had a higher position than the lender or the lender’s concurrent separatists in bankruptcy legislation

ÂÂ

Keywords: Debt Tax, Pailid, A Creditor Preferen, The Right Before.

References

Darwin, 2009, Pajak Bumi dan Bangunan, Jakarta : Mitra Wacana Media.

Djafar, Saidi, 2007, Perlindungan Hukum Wajib Pajak dengan Penyelesaian Sengketa Pajak, Makasar: Raja Grafindo Persada.

Zuraida, Ida, Penagihan Pajak: Pajak Pusat dan Pajak Daerah, Bogor: Ghalia Indonesia.

Huizink, J.B, 2004, Insoventie, alih bahasa linus Dolujawa, Jakarta: Pusat Studi Hukum dan Ekonomi Fakultas Hukum, Universitas Indonesia.

Jono, 2008, Hukum Kepailitan, Jakarta: Sinar Grafika.

Retnowulan, 1996, Kapita Salekta Hukum Ekonomi dan Perbankan, Sari Varia Yustisia

Saragih, R. F. dan Erna Widjajati, 1991, Hukum Pajak di Indonesia, Jakarta, Roda Inti Media.

Soemitro, Rochmat, 1991, Asas dan Dasar Perpajakan 2, Bandung: PT. Eresco.

Sunarmi, 2010, Hukum Kepailitan, edisi 2, Jakarta: PT. Sofmedia.

Undang-Undang Nomor 19 tahun 2000 perubahan atas Undang-Undang 19 tahun 1997 Tentang Penagihan Pajak Dengan Surat Paksa.

Undang-Undang Nomor 28 tahun 2007 Tentang Ketentuan Umum dan Tata Cara Perpajakan.

Undang-Undang Nomor 37 Tahun 2007 Tentang Kepailitan dan Penundaan Kewajiban Pembayaran Utang.