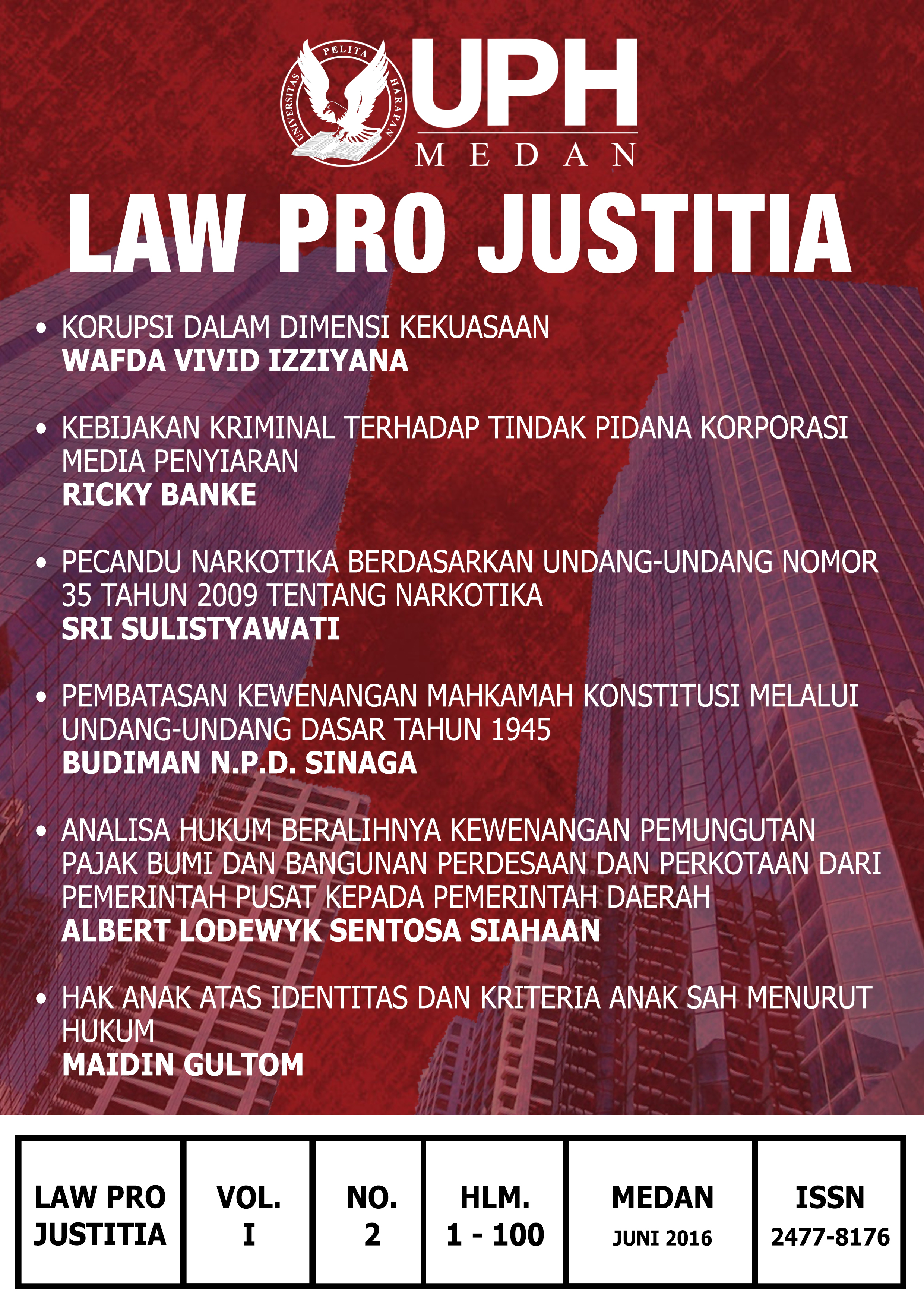

ANALISA HUKUM BERALIHNYA KEWENANGAN PEMUNGUTAN PAJAK BUMI DAN BANGUNAN PERDESAAN DAN PERKOTAAN DARI PEMERINTAH PUSAT KEPADA PEMERINTAH DAERAH

Abstract

The objective of this study is to analyze how the authority to collect properties taxes for villages and cities before and after transferring it by central government over local administration bases to Regulations No. 19 of 2000 on Local Taxes and Local Levies. This study adopted normative research such in legal research, where sources of secondary data and primary data obtained by library research which by adopted legal principles, sources of legal, theory of legal, books and regulations rules. This research pointed out that following transfer of authority to collect the taxes by central government over local administrations that for every management of taxes on properties for villages and cities either for calculating, decision on tariff and rate value of object to tax, controlling, then to collect the taxes transferred over local government. It concluded that assumed it must be well to see the aims transfer authority function to collect the taxes such as existed balancing and to improve the local administration’s income by central government. It emerged a problem has been not solved yet in transferring the authority the authority namely highly bad debt existed not collected yet by central government so the arrears as if allowable and local administration do not care for action. How to collect the taxes has been a main point to expose and evaluate precisely to collect is done by seizure body meanwhile mostly local administrations has no agent alike so many times the local administration invite aids by police and attorney to take action in field, where by the action still no any legal power yet and it may cause legal uncertainly.

ÂÂ

Keywords : transfer of authority, properties taxes, Rural, Urban, Government.

References

Darwin, 2009. Pajak Bumi dan Bangunan. Jakarta: Mitra Wacana Media.

Darwin, 2010. Pajak Daerah dan Retribusi Daerah. Jakarta: Mitra Wacana Media.

Djafar, Saidi, 2007. Perlindungan Hukum Wajib Pajak dengan Penyelesaian Sengketa Pajak. Makasar: Raja Grafindo Persada.

Ganjong, 2007. Pemerintah Daerah Kajian Politik dan Hukum, Bogor: Ghalia Indonesia.

Marzuki, Peter, 2009. Penelitian Hukum, Malang: UMM Press.

Mustaquim, 2008, Pajak Daerah. Yogyakarta: FH UII Press.

HS, Salim dan Nurbani, Erlies. Penerapan Teori hukum pada penelitian tesis dan disertasi, Jakarta: PT: Rajagrafindo Persada.

Kaloh, 2002, Mencari Bentuk Otonomi Daerah (Suatu Solusi dalam menjawab kebutuhan local dan tantangan Global), Jakarta: Rineke Cipta.

Siahaan, Albert, 2014. Kajian Yuridis Terhadap Beralihnya Kewenangan Pemungutan Pajak Bumi dan Bangunan Perdesaan dan Perkotaan dari Pemerintah Pusat Kepada Pemerintah Daerah Kabupaten Serdang Bedagai, Medan: Fakultas Hukum Universitas Sumatera Utara.

Undang-Undang nomor 19 tahun 1994 perubahan atas Undang-Undang nomor 19 tahun 1985 tentang Pajak Bumi dan Bangunan.

Undang-Undang nomor 19 tahun 2000 perubahan atas Undang-Undang nomor 19 tahun 1997 tentang Penagihan Pajak dengan Surat Paksa.